geothermal tax credit iowa

1 2019 and is available for Iowa homeowners on Iowa residential properties. The federal credit is set to expire December 31 2016.

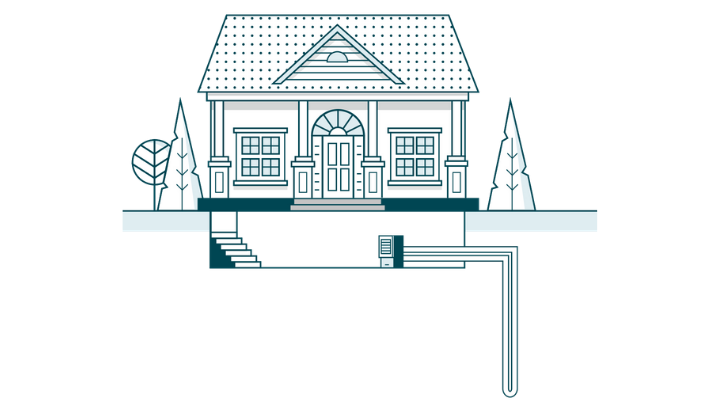

Geothermal Ground Loop Faqs Dandelion Energy

Enter in column C of Part I on the IA 148 Tax Credits Schedule.

. Geothermal Heat Pump Tax Credit. Geothermal Heat Pump Tax Credit 2 wwwlegisiowagov Doc ID 1156247 Fiscal Year Tax Credit Redemptions Fiscal Year Tax Credit Redemptions FY 2006 0 FY 2016 1895682 FY 2007 0 FY 2017 2185938 FY 2008 0 FY 2018 502511 FY 2009 0. The Credit was available during calendar years CY 2017 and CY 2018 and was repealed January 1 2019.

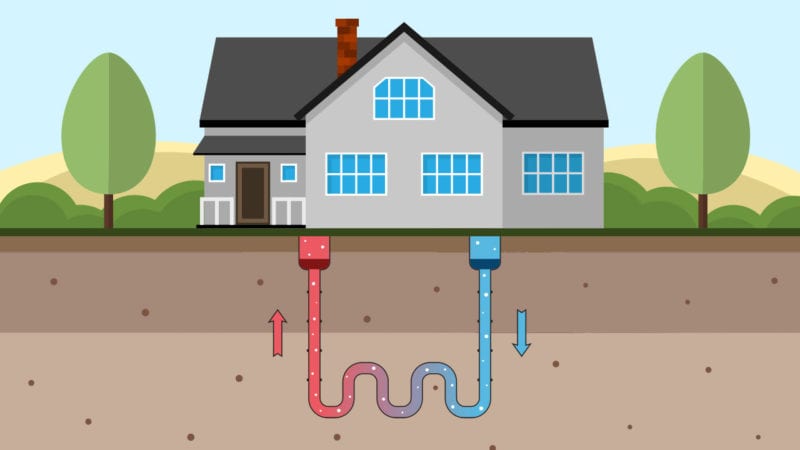

See Iowa Code section 42211N. Geothermal Tax Credit The Geothermal Tax Credit equaled 100 of qualified residential geothermal system installation costs. This includes labor onsite preparation equipment assembly and the necessary piping and wiring used when connecting the system to the home.

Geothermal tax credits 4247. Enter Your Zip See If You Qualify. Effective Date Wed 05262021 - 1200 Link to Rule Geothermal Heat Pump Tax Credit Tax Type Other Taxes Stay informed subscribe to receive updates.

This new income tax credit replaces previous geothermal-related income tax credits that were repealed by the Iowa legislature effective in 2019. REVENUE DEPARTMENT 701 Notice of Intended Action. The Geothermal Tax Credit filed through form 5695 covers expenses associated with the installation of ground source heat pumps.

The 22 credit applies to geothermal equipment placed in service during 2022. The equipment must meet the federal energy star. 1 2019 and is available for Iowa homeowners on Iowa residential properties.

Most local utilities offer a handsome incentive for. 41-169b 071218 2018 IA 140 Iowa Geothermal Tax Credit Instructions. For geothermal heat pump units installed on or after January 1 2019.

November 9 2021 Tax Credit. Subscribe to Updates Footer menu About Contact Us. The credit became available on January 1 2009 and sunsets January 1 2021.

Iowa Geothermal Tax Credit unused in tax year 2017. Once awarded Geothermal Heat Pump Tax Credits reach the maximum amount of tax credit awards 1563638 in 2021 the Department will establish a waitlist also on a first-come first-served basis. The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022.

An application on the waitlist as described above shall not constitute a promise binding the state. The American Recovery and Reinvestment Act adopted in October 2008 allows for a 22 tax credit for costs associated with ENERGY STAR qualified geothermal heat pumps as noted in section 25D of the Internal Revenue Code. The Iowa Geothermal Tax Credit is effectively a 52 credit based on a formula of 20 of the federal residential energy-efficient property tax credit which is 26 for tax years 2020 through 2022.

Iowa had a short term program for geothermal and the funding was depleted in short orderOther Local Incentives. Tax credit applications must be submitted to the Iowa Department of Revenue by May 1 of the year following the year of installation or the application will be denied. Bryan DeJong of Baxter Oil Company Baxter IA and Justin Larsen of Camblin Mechanical Inc Atlantic IAQuick FactsFederal Tax Credit.

Ad Enter Your Zip Code - Get Qualified Instantly. The credit is available for units installed on or after Jan. Twenty-five interested persons a governmental subdivision an agency or association of 25 or more persons may demand an oral presentation hereon as provided in Iowa Code section 17A4 1b Notice is also given to the public that the Administrative.

The highest tax credit available is 008 per pure ethanol gallon. The deadline to submit an application is May 1 following the year of installation. Geothermal Tax Credit 2 wwwlegisiowagov Doc ID 1231477 Fiscal Year Tax Credit Redemptions Fiscal Year Tax Credit Redemptions FY 2007 0 FY 2017 0 FY 2008 0 FY 2018 317469 FY 2009 0 FY 2019 1206937 FY 2010 0 FY 2020 277352.

Check 2022 Top Rated Solar Incentives in Iowa. _____ IA 148 Tax Credits Schedule must be completed. Beginning with 2019 installations the geothermal tax credit is capped at 1 million total credits per year and is subject to award by the Iowa Department of Revenue.

The credit is only allowed on residential properties located in Iowa. The Iowa Geothermal Tax Credit is. This credit is equal to 200 of the federal residential energy efficient property tax credit allowed for geothermal thermal heat pumps.

November 19 2020 Tax Credit. The credit is available for units installed on or after Jan. Check Rebates Incentives.

Geothermal Installations after December 31 2018 Geothermal installations beginning on or after January 1 2019 must apply for a Geothermal Heat Pump Tax Credit. Effectively a 52 percent credit based on a formula of 20 of the federal residential energy efficient property tax credit which is 26 for tax years 2020 through 2022. 2017 IA 140 Iowa Geothermal Tax Credit Instructions The Iowa Geothermal Tax Credit equals 10 of taxpayers qualified expenditures on equipment that uses the ground or groundwater as a thermal energy source to heat the taxpayers residence or as a thermal energy sink to cool the residence.

Iowa provides a geothermal heat pump tax credit the 20 credit for Iowa individual income tax liability equal to 20 of the federal residential energy efficient property tax credit allowed for geothermal heat pumps in residential property located in Iowa. Certain electrical upgrades may also be eligible. Ground Floor State Capitol Building Des Moines Iowa 50319 5152813566 Tax Credit.

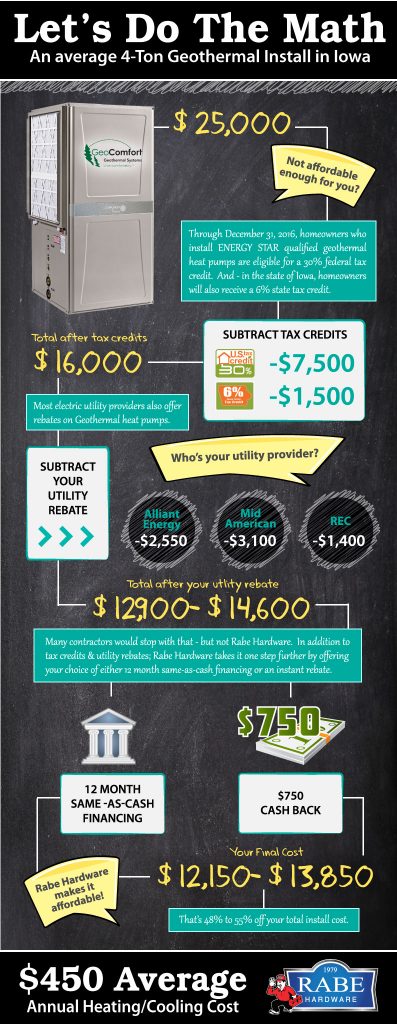

Geothermal Cost Breakdown Surprisingly Affordable

Standards And Best Practices Green Up West Union

Geothermal Hvac System Installation Repair Des Moines Ia

Top 14 Geothermal Myths Debunked Dandelion Energy

Iowa S New Tax Structure In 2022 And Beyond

Geothermal Heat Pumps Western Iowa Power Cooperative

Geothermal Cost Breakdown Surprisingly Affordable

Geothermal Ground Loop Faqs Dandelion Energy

Top 14 Geothermal Myths Debunked Dandelion Energy

Geothermal Solutions In The Brazos Valley Barker S Heating And Cooling